As the owner of a life insurance policy, you have certain expectations and rights. One of those rights is the ability to sell that policy to a third party for an immediate, one-time lump sum payment, or settlement. Whatever your policy type—term, group, universal—they are nearly all eligible to be sold.

Two of the settlement choices available, viatical settlements and life settlements, share some similarities, but they also have key differences. These include who qualifies, how benefits are calculated, and how the lump sum payment is taxed.

Let’s start with some definitions:

Viatical Settlements

A viatical settlement is an option for life insurance policyholders who have been diagnosed as terminally ill, usually with under two years to live, although that can vary. Additionally, the policy must have been in force for at least two years and must have a death benefit of at least $100,000. The age of the policyholder does not matter.

A major reason policyholders initiate a viatical settlement is to help pay for the often overwhelming expenses that come with a terminal diagnosis, including medical treatment, home care professionals, etc.

Life Settlements

With a life settlement, also called a senior settlement, the policyholder must be at least 65 years old, but are most often in their seventies. They must have a policy that’s been in force for at least two years with a death benefit of at least $100,000.

Policyholders usually choose this option because they have expenses they cannot meet or because they can no longer afford to, or no longer wish to, pay their premiums.

Viatical settlements vs. life settlements: Similarities

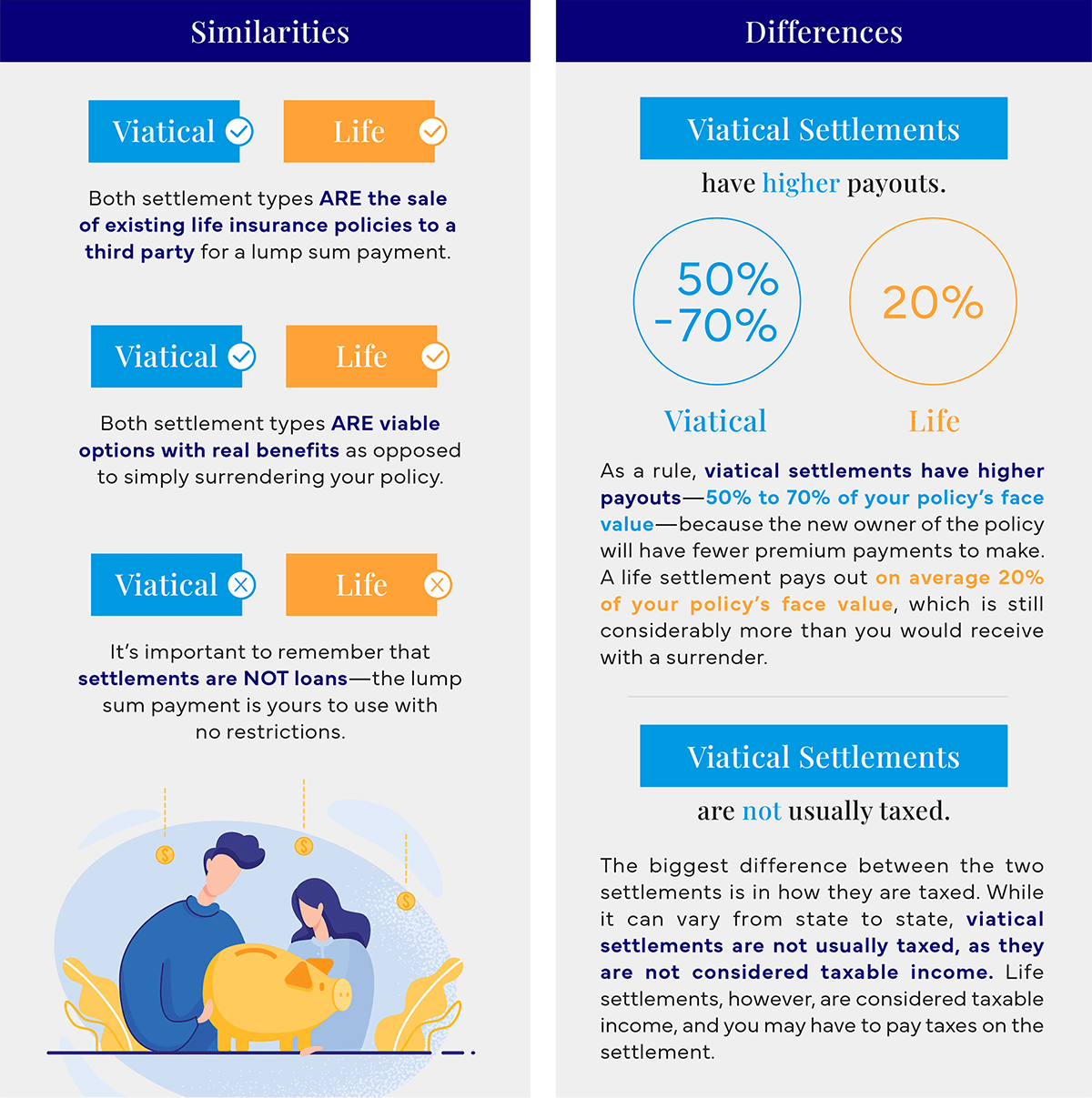

Viatical settlements and life settlements are both the sale of existing life insurance policies to a third party for a lump sum payment. Both settlement types are viable options with real benefits as opposed to simply surrendering your policy.

It’s important to remember that settlements are not loans—the lump sum payment is yours to use with no restrictions.

Viatical settlements vs. life settlements: Differences

As a rule, viatical settlements have higher payouts—50% to 70% of your policy’s face value—because the new owner of the policy will have fewer premium payments to make. A life settlement pays out on average 20% of your policy’s face value, which is still considerably more than you would receive with a surrender.

The biggest difference between the two settlements is in how they are taxed. While it can vary from state to state, viatical settlements are not usually taxed, as they are not considered taxable income. Life settlements, however, are considered taxable income, and you may have to pay taxes on the settlement.

Make an Informed Decision

The decision as to whether you should choose to seek a viatical or life settlement should not be taken lightly. Not all life settlement companies are the same. Do your research and choose a company with the knowledge, experience, and resources to guide you through the entire process.

If you are considering the sale of your life insurance policy, contact the experts at PolicyBank® for more information so we can help you make an informed decision.