A life insurance buyout is a way for you as a policy holder to legally sell your life insurance policy to a third party. This buyout is called a settlement, and it allows you to sell your life insurance policy for a one-time, lump sum payment. In exchange, the buyer of your policy assumes your monthly premium payments and collects your death benefit upon your death.

Seeking a life insurance buyout is an important personal and financial decision, but the reason many people choose to do so rather than simply canceling or surrendering their policy is clear. On average, you’ll receive a much larger payout than if you surrender your policy—at least four times more.

There are two types of settlements, or buyouts—life settlements and viatical settlements.

Life Settlements

A life settlement is also called a senior settlement. In order to qualify for a life settlement, you have to meet certain minimum requirements. You must be at least 65 years old, although the policy holders seeking a life settlement are often in their seventies. You must have a life insurance policy in good standing, one that’s been in force for at least two years, with a death benefit of at least $100,000.

Why do policyholders choose to sell their life insurance policies and seek a life settlement? They may no longer have a need for life insurance, they may have immediate expenses they cannot meet, or they may no longer be able to afford their premiums.

Viatical Settlements

Policy holders who have been diagnosed as terminally ill, usually with under two years to live, have the option to seek a viatical settlement. Although the age of the policy holder does not matter in this case, the policy must have been in force for at least two years and must have a death benefit of at least $100,000.

Policy holders tend to seek a viatical settlement to help pay for the medical treatments, home care professionals, and other expenses that come with a terminal diagnosis.

Similarities and Differences

Viatical settlements and life settlements are both life insurance buyouts, but there are a couple of key differences. Viatical settlements tend to have higher payouts—50% to 70% of your policy’s face value—because the new owner of the policy will have fewer premium payments to make. By comparison, the average payout for a life settlement is 20%.

The other big difference is in how they are taxed. While it can vary from state to state, viatical settlements are not usually taxed, as they are not considered taxable income. Life settlements, however, are considered taxable income, and you may have to pay taxes on the settlement.

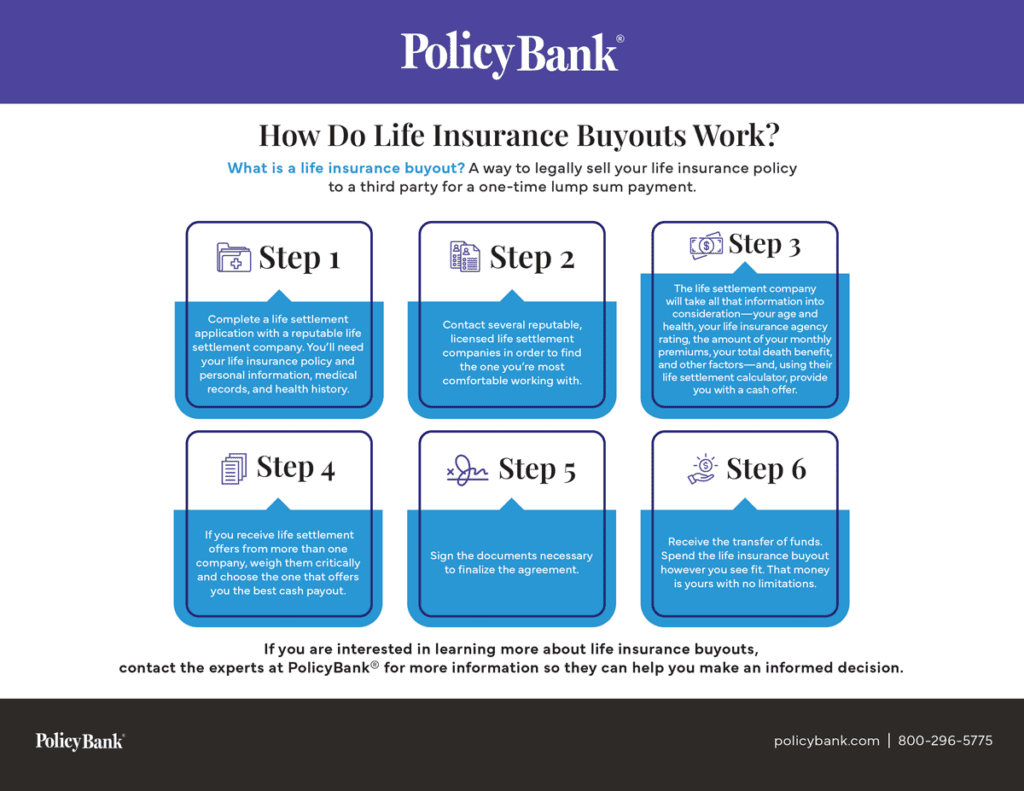

How Exactly Does a Life Insurance Buyout Work?

There are a series of steps involved:

- Complete a life settlement application with a reputable life settlement company. You’ll need your life insurance policy and personal information, medical records, and health history.

- Contact several reputable, licensed life settlement companies in order to find the one you’re most comfortable working with.

- The life settlement company will take all that information into consideration—your age and health, your life insurance agency rating, the amount of your monthly premiums, your total death benefit, and other factors—and, using their life settlement calculator, provide you with a cash offer.

- If you receive life settlement offers from more than one company, weigh them critically and choose the one that offers you the best cash payout.

- Sign the documents necessary to finalize the agreement.

- Receive the transfer of funds. Spend the life insurance buyout however you see fit. That money is yours with no limitations.

If you are interested in learning more about life insurance buyouts, contact the experts at PolicyBank® for more information so they can help you make an informed decision.