No matter who your insurance company may be—Metlife, American Income, Primerica, Americo, Unum, Lincoln Financial, Cigna, the list goes on—life insurance payouts work in much the same way.

What does make a difference, however, is the type of life insurance you have, either term life or whole life.

Term Life Insurance

A term life insurance policy provides coverage for a defined period of time, usually between ten and thirty years, and for a defined payout amount. As a policy holder, you pay a monthly premium while the policy is in effect, and if you die during that term, a death benefit is paid out to your beneficiaries.

Much like other forms of insurance, such as car or homeowners, which do not pay out except in the case of some sort of accident or incident, term life insurance only pays out if you pass away while the policy is in effect.

99% of all term life insurance policies do not pay a death benefit, either because the policy holder does not die during the term of the policy or because the policy holder stops paying the premiums. While term life premiums are much less expensive than whole life, it can still be money wasted.

Whole Life Insurance

A whole life insurance policy, also known as permanent life insurance, remains in effect for as long as you live as long as you don’t stop making premium payments. Unlike with a term policy, a whole life policy builds cash value that can be borrowed against for personal use, such as major expenses or your childrens’ college. Keep in mind that borrowing funds reduces your death benefit.

You can also use the earned cash value to pay your insurance premiums. Whole life insurance premiums tend to be considerably more expensive than term premiums.

Upon your death, the death benefit is paid out to your beneficiaries.

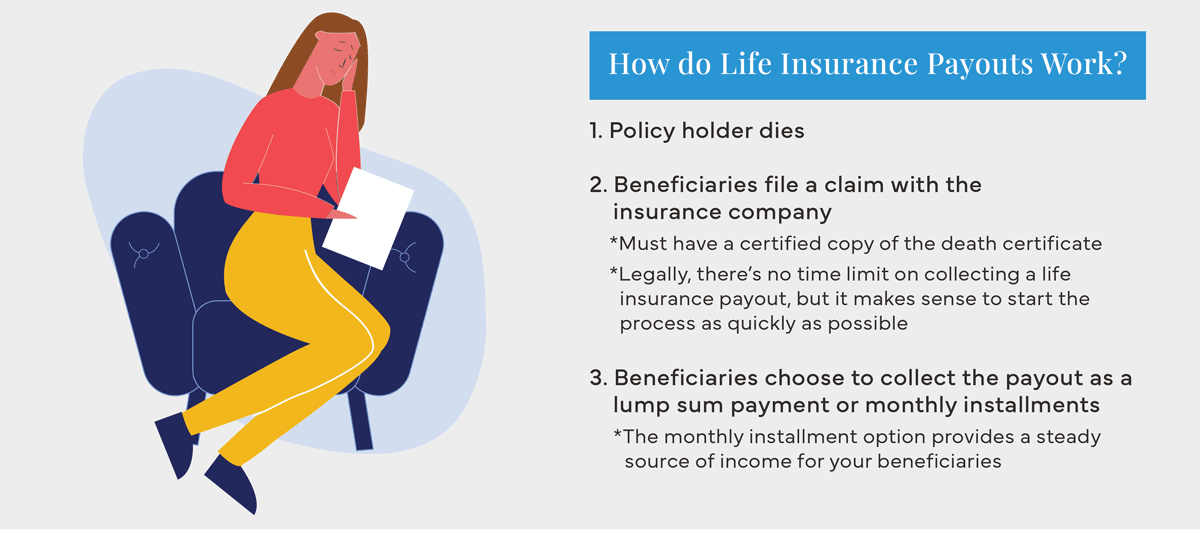

How Life Insurance Payouts Work

Upon your death, your beneficiaries must file a claim with your insurance company in order to collect your death benefit, including providing a certified copy of the death certificate. This can usually be processed relatively quickly unless the insurance company suspects there is fraud involved. Legally, there’s no time limit on collecting a life insurance payout, but it makes sense to start the process as quickly as possible.

Your beneficiaries can choose to collect the life insurance payout as a lump sum payment, which is most common, or in monthly installments. The monthly installment option provides a steady source of income for your beneficiaries.

Another Option

Depending on your life circumstances, you may want to consider selling your insurance policy rather than continuing to pay your premiums. This is particularly true if you are thinking about canceling or surrendering your life insurance policy. As the policy holder, you can legally sell both term life and whole life insurance policies to a third party for a one-time cash payment, called a settlement. With a settlement, you’ll receive a much larger payout than if you surrender your policy—at least four times more on average.

Life settlement companies look at a number of factors when determining if your life insurance policy qualifies to be purchased, such as your age, health, the type of life insurance policy you have, and the size of the policy. A licensed, reputable life settlement company can explain the entire process and help you decide if a settlement is the right choice for you.

If you are interested in learning more about selling your life insurance policy, contact the experts at Policybank® for more information so they can help you make an informed decision.