Whatever your reasons—maybe you can no longer afford the premiums, or maybe you need a large amount of money immediately—as a life insurance policy holder, you are legally allowed to sell your policy to a third party for a one time cash payment, which is called a life settlement. The life settlement company that purchases your policy becomes the new owner, assuming your premiums and eventually collecting the death benefit.

The chief benefit of selling your life insurance policy over simply surrendering it is that you’ll receive considerably more money—at least four times more on average.

Once you’ve ascertained that you meet the minimum requirements necessary to seek a life settlement…

- You’re at least 65 years old.

- Your life insurance policy has been in force for at least two years.

- Your policy carries a death benefit of at least $100,000.

…Your next step is to talk to several life settlement brokerages or companies in order to find the one that will best work with you and get you the largest cash settlement. It pays to shop around, not only for the best offer, but for a company that will guide you every step of the way through the life settlement transaction. Be sure they are licensed to work in your state.

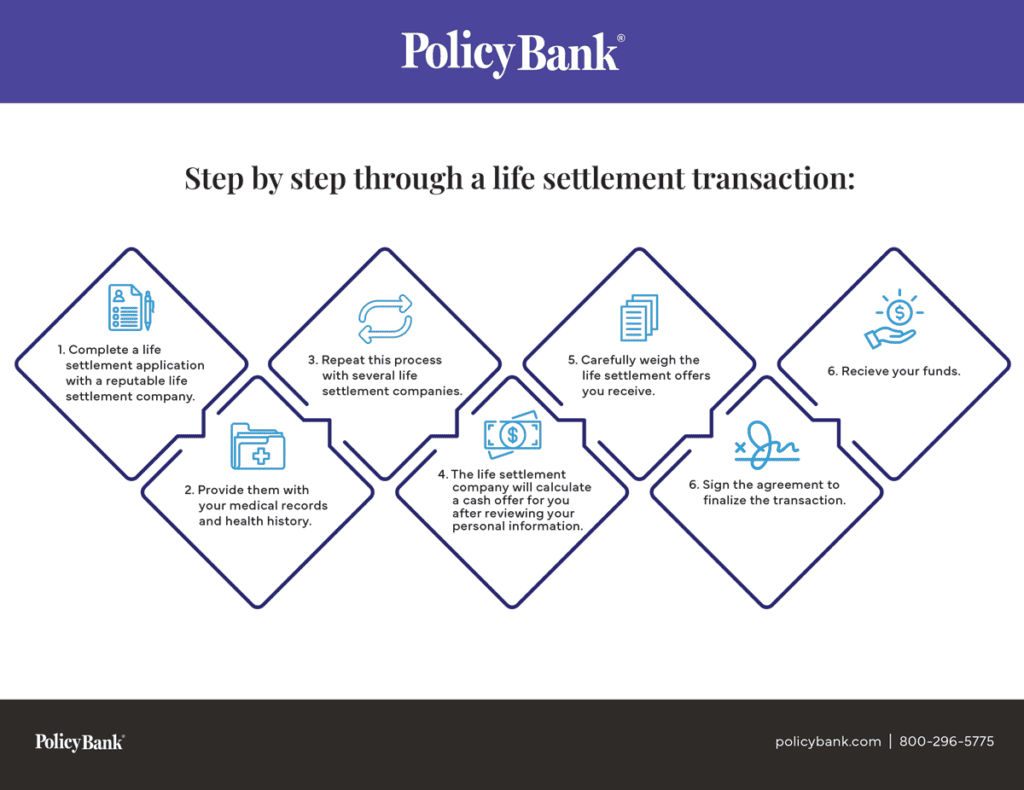

How exactly does a life settlement transaction work?

Let’s break the transaction down step by step.

- Complete a life settlement application with a reputable life settlement company. This is necessary, as you need to qualify for a settlement. In order to apply, you’ll need your life insurance policy and personal information. You will also need to authorize the company to contact your insurance agency.

- Provide the life settlement company with your medical records and health history. You may need to authorize your healthcare providers to release that information.

- If you contact more than one life settlement company, as is recommended, you’ll have to repeat this process with each of them.

- The life settlement company will take all that information into consideration—your age and health, your life insurance agency rating, the amount of your monthly premiums, your total death benefit, and other factors—and, using their life settlement calculator, provide you with a cash offer.

- If you receive life settlement offers from more than one company, weigh them critically and choose the one that most benefits you.

- Sign the documents necessary to finalize the agreement.

- Receive the transfer of funds. That cash is yours to spend however you see fit with no limitations.

Choose the life settlement company that works best for you

Finding the right life settlement company is a big decision, and knowledge and experience matters. Take your time, do your homework, and make an informed decision.

When you’re ready to discuss selling your life insurance policy, the life settlement experts at PolicyBank® are always here to answer your questions and guide you every step of the way.