There are a variety of reasons you, as a life insurance policy holder, may choose to sell your policy to a third party for a one-time cash payment, known as a settlement.

A life settlement is an option for policyholders that are at least 65 years old and have a policy that has been in force for at least two years with a death benefit of at least $100,000. Those seeking a life settlement often do so because they no longer wish to pay their premiums, or they can no longer afford to.

A Viatical settlement is an option for policyholders who have been diagnosed with a terminal illness with less than two years to live. Their age does not matter, but again, their policy must have been in force for at least two years and have a death benefit of at least $100,000. With a viatical settlement, the overwhelming expenses that accompany a terminal diagnosis are often the reason a settlement is sought.

Whichever type of settlement you choose to seek, chances are that your first question will be: how much can I sell my life insurance policy for? The easy answer to that question is that you can sell it for considerably more than if you were to simply surrender your policy—at least four times more on average.

Generally speaking, a policyholder seeking a settlement can receive between 10% and 35% of the death benefit with an average payout of around 20%. That would be, for example, $20,000 on a $100,000 life insurance policy. Exactly how much your life insurance policy is worth, however, depends on several factors.

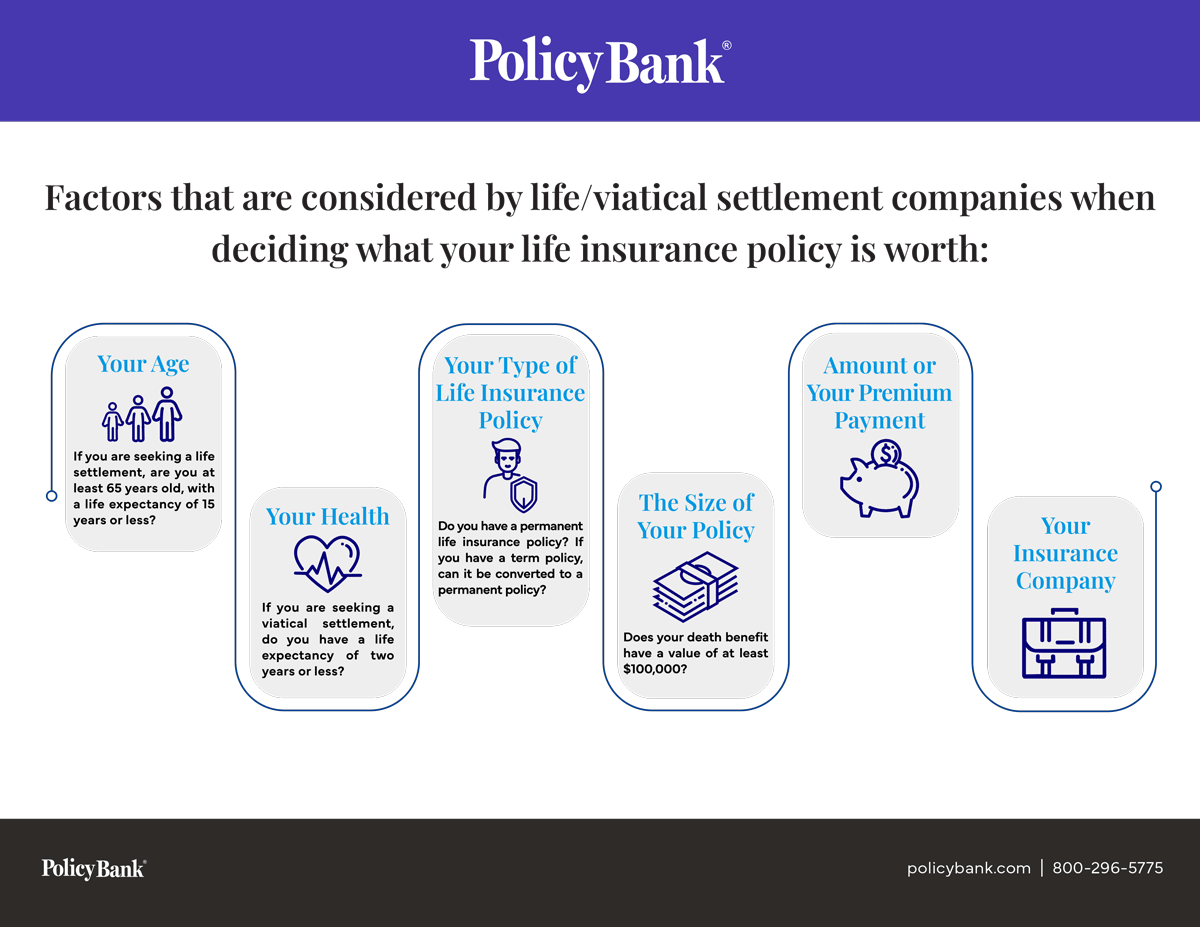

Factors that are considered by life/viatical settlement companies

- Your age. You must be a minimum of 65 years old to qualify, but the older you are, the more your life insurance policy may be worth. A life expectancy or 15 years or less is preferable. If you have been diagnosed with a terminal illness and are seeking a viatical settlement, your age is not important.

- Your health. Again, your life expectancy plays a critical role in determining the amount of your settlement, and your overall health is an important part of that for both life and viatical settlements. For this reason, viatical settlements are often larger than life settlements.

- The type of life insurance policy you have. Most types of life insurance policies can be sold, but some are more easily sold than others. For instance, a term life insurance policy must first be converted to a permanent life insurance policy before it can be sold.

- The size of the policy. As stated above, your policy must have a death benefit of at least $100,000. In the case of a whole or universal life insurance policy, if you’ve borrowed against the policy and not paid it back, that reduces the value of the death benefit.

- The amount of your premium payment. When you sell your life insurance policy to a life/viatical settlement company, they assume your premium payments, so the amount of those payments matters.

- Your life insurance company. Settlement companies prefer to work with reputable, licensed, and bonded insurance companies.

It pays to shop around

Different settlement companies weigh these various factors in different ways, so it pays to shop around. Be sure the life/viatical companies you talk to are licensed by your state, in good standing, have the experience to guide you through the entire process, and will reward you with the very best cash offer.

Are you exploring the possibility of selling your life insurance policy? The life/viatical settlement experts at PolicyBank® are happy to answer your questions and help you make an informed decision.