As Americans near retirement age, they may discover the existence of life insurance settlements. The concept is simple—life insurance policy holders are legally allowed to sell their policies to a third party for a one-time lump sum cash payment, or settlement.

There are two settlement choices available: life settlements and viatical settlements.

With life settlements, a policy holder of at least 65 years of age with a policy that’s been in force for at least two years and a death benefit of at least $100,000 can sell their policy. This is often done because the policy holder no longer desires to, or cannot afford to, pay their insurance premiums. With a life settlement, the policy holder will not receive the full death benefit of their policy, but will usually get substantially more than the meager cash surrender value of the policy.

Viatical settlements, on the other hand, are an option for life insurance policy holders who are terminally ill, generally with less than two years to live. Their age doesn’t matter as long as their policy has been in force for at least two years and they have a death benefit of at least $100,000. A terminal diagnosis often leads to formidable expenses, which explains the possible need for viatical settlements.

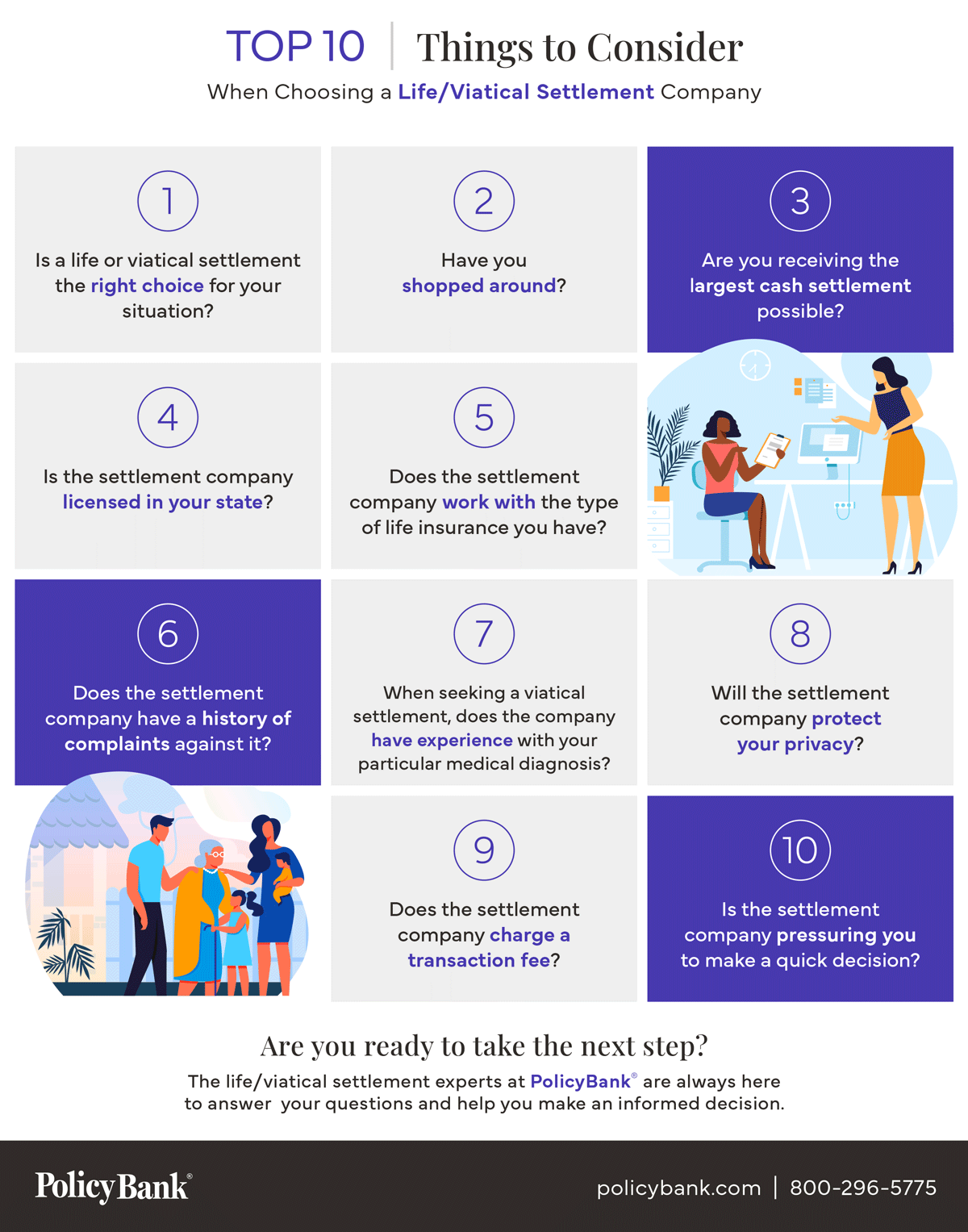

Should you decide that a settlement is something you want to consider, then the question becomes: how do you choose the life/viatical settlement company that’s right for you?

Things to consider when choosing a life settlement company

First and foremost, don’t hesitate to shop around. There are many choices available to you, and not all of them have your best interest at heart.

Part of shopping around includes getting the largest cash settlement possible. Payouts can vary widely from company to company, so be sure you’re getting the best deal.

Is the settlement company licensed in your state? Many states require licensing, but not all.

There are many types of life insurance policies. Does the settlement company work with the kind of policy you have?

Does the settlement company have a history of complaints against it? Do they have a reputation as an honorable, trustworthy business?

If you are seeking a viatical settlement, does the settlement company have experience with your particular medical condition? This is important, as it may impact the size of your settlement offer.

All settlement companies require a great deal of your personal information in order to qualify you, from your life insurance details to your medical records. Will they protect your privacy or sell it to another party? It’s within your rights to know what they will do with that information.

Does the settlement company charge a transaction fee? If so, how much is it?

Finally, if you feel as though a settlement company is pressuring you to make a quick decision, walk away. You have the right to take your time and make the right decision for you.

Are you ready to take the next step? The life/viatical settlement experts at PolicyBank® are always here to answer your questions and help you make an informed decision.