A term life insurance policy is one in which you pay monthly premiums for a defined period of time, generally between 10 and 30 years, and in return, the insurance company pays out a death benefit—an agreed upon amount of money—should you die during that time period.

Like many other forms of life insurance, you are legally allowed to sell your term life insurance policy to a third party for a one-time cash payment, or settlement.

There are two types of settlements available depending on your situation:

A life settlement is for a life insurance policyholder who is at least 65 years old.

A viatical settlement is for a policyholder who has been diagnosed as terminally ill with a life expectancy of two years or less. In this case, your age doesn’t matter.

In either case, selling a term life insurance policy is different from selling a whole life insurance policy. In order to sell a term life insurance policy, there are additional things to consider and steps to take.

Key difference

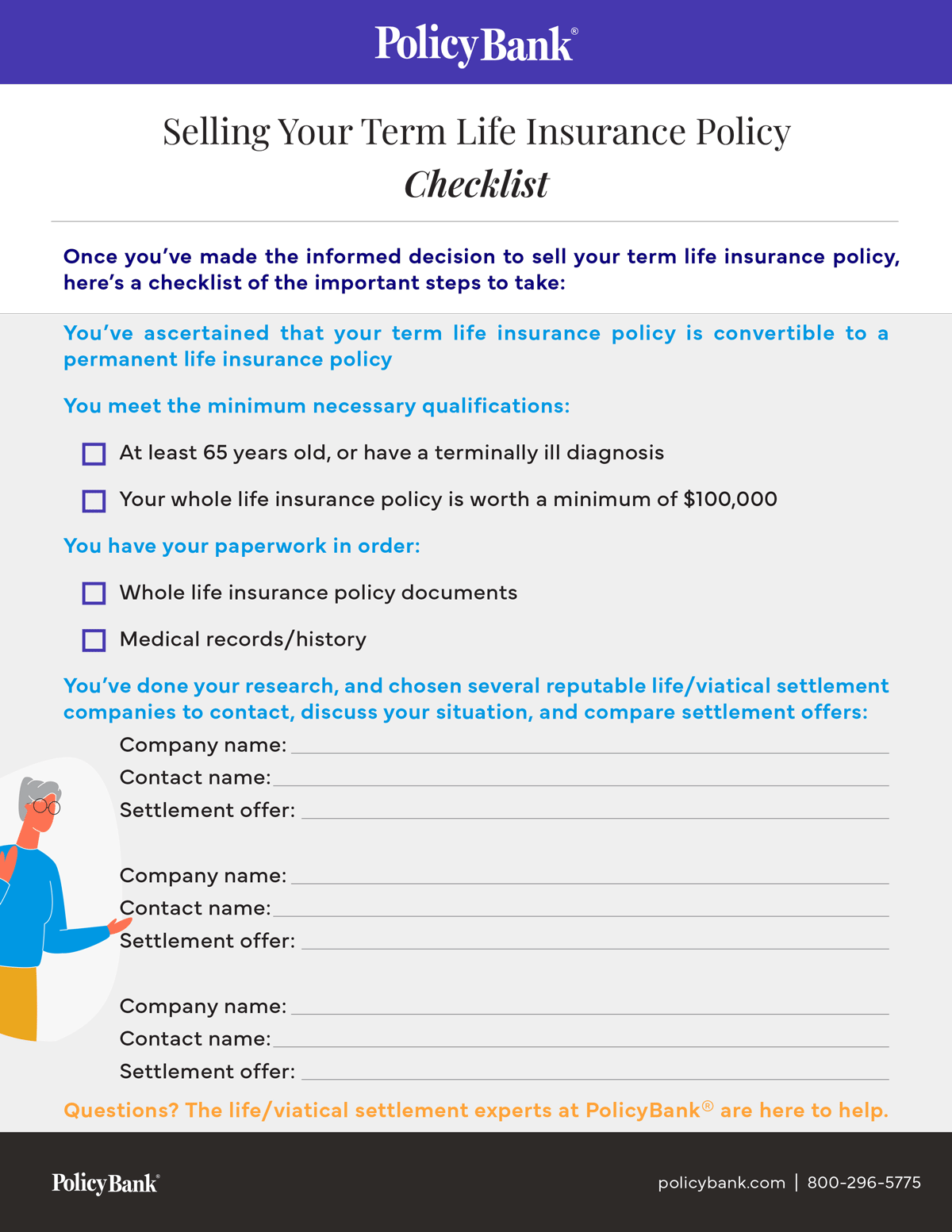

The key difference when selling a term life insurance policy is that it must first be converted to a permanent life insurance policy, as only convertible term policies are eligible to be sold. Permanent life insurance—either whole life or universal life—has no time limit and remains valid until your death, assuming you’ve continued to make your premiums.

Step by step: Sell your term life insurance policy

- Step one is figuring out if your term life insurance policy can be converted. Most, though not all, term policies are available for conversion. You’ll have to read through your policy.

- If your policy is available for conversion, there may be a defined time frame—a conversion period—during which it’s allowed. Again, check your policy.

- You can also talk to your insurance agent about converting your policy if you’re not sure.

- Be sure your policy also meets other minimum qualifications. It must have been in force for at least two years with a death benefit of at least $100,000.

- Gather together all your insurance policy documents and medical records/history. They’ll be essential for talking to life/viatical settlement companies. You’ll want to make multiple hard copies, because…

- It’s in your best interest to shop around. Talk to several reputable settlement companies in order to find one that not only wants to work with you, but will offer you the best cash payout. Be sure they are licensed in your state and take the time to explain the terms and conditions of the sale.

- Selling your term life insurance policy is a big decision that should not be taken lightly. If you feel rushed by the company, don’t be afraid to walk away.

- Review any settlement offers you receive and choose the one that works best for you.

- Sign the paperwork and accept your cash settlement. You are free to do whatever you want with the money, and there are no limitations on how you spend it.

Reputation matters

Not all life/viatical settlement companies are the same. Choose to work with one that has a reputation for honesty, experience, and positive outcomes.

If you are considering the sale of your term life insurance policy, the experts at PolicyBank® are here to help you make an informed decision.