A whole life insurance policy is what many people think of when they hear the term life insurance. It’s a traditional form of life insurance, into which the insured makes regularly-scheduled premium payments throughout their lifetime, unlike term life insurance, which the insured pays into for a set number of years. Upon the policyholder’s death, a death benefit is paid to the beneficiary or beneficiaries as specified by the policyholder.

One thing that sets whole life apart from other forms of life insurance is that the policy also includes a cash savings component, which accrues interest and may be borrowed from.

You may have wondered: “Can I sell my whole life insurance policy?”

Like nearly all forms of life insurance, a whole life insurance policy can be sold to a third party for an immediate, one-time lump sum payment, also known as a settlement. At that point, the buyer assumes responsibility for the premium payments, and receives the death benefit upon the seller’s death.

Why sell your whole life insurance policy?

Selling your whole life insurance policy is not a decision to be made lightly, but there are several possible reasons why it may be the best course of action.

With life settlements, or senior settlements, which happen when the policyholder is at least 65 years old but is in reasonably good health, the policyholder often has expenses they cannot meet, or they can no longer afford to pay their premiums. This is especially true with whole life insurance, as the premiums tend to be higher than with many other forms of life insurance.

In the case of viatical settlements, which are an option for policyholders who have been diagnosed as terminally ill, the policyholder may need the cash from a settlement to help pay for the medical expenses and long-term care that comes with such a diagnosis.

Steps to take when selling your whole life insurance policy

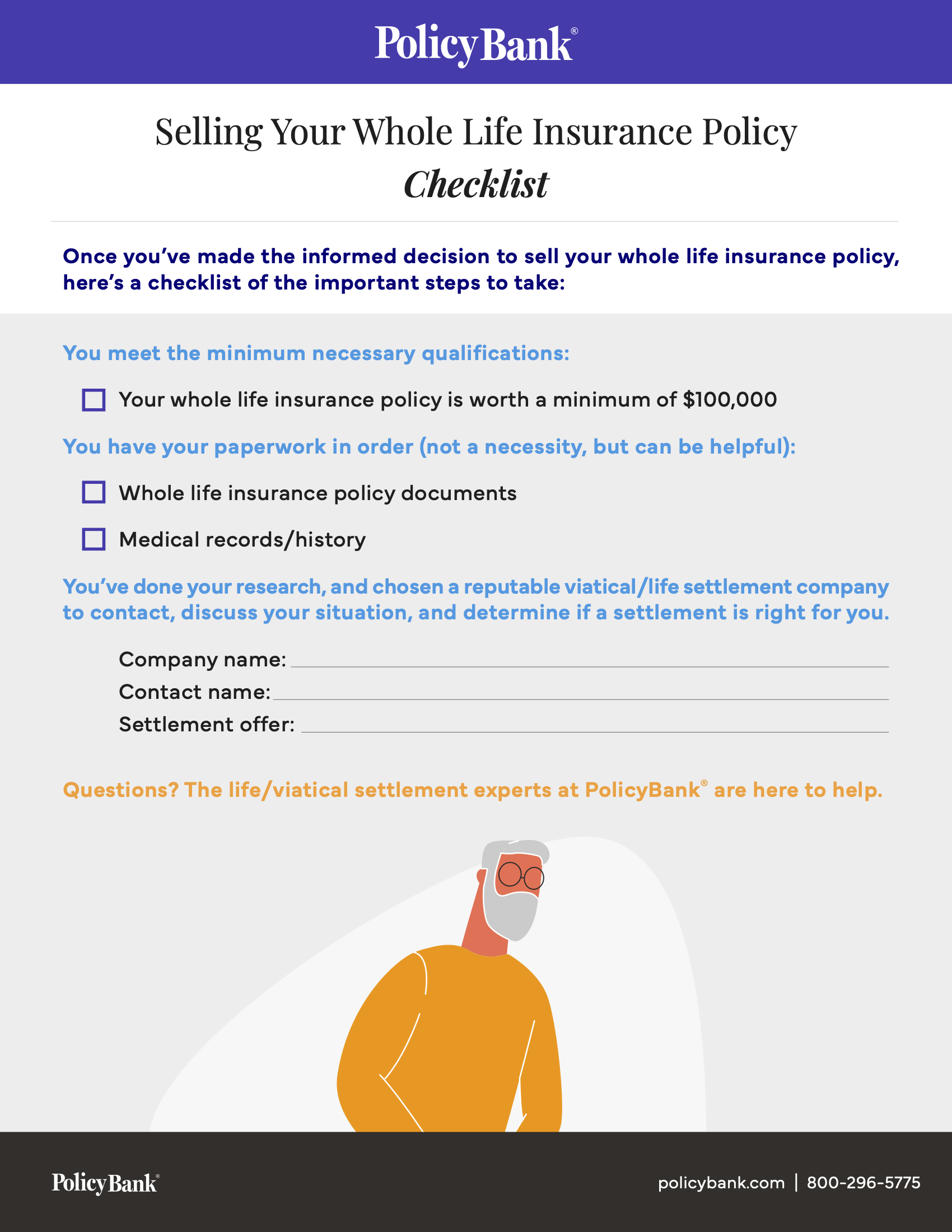

- First, make sure you meet the minimum qualifications—you’re at least 65 years old (or have a terminally ill diagnosis, in which case your age doesn’t matter), and your whole life insurance policy is worth a minimum of $100,000.

- Get your paperwork together. An experienced, reputable life/viatical settlement company will require your life insurance policy documents, along with your medical records/history. This will help them decide if they want to work with you.

- Do your research. Find the life/viatical settlement company that will best meet your needs. Choose a company that will guide you through the entire process, and secure for you the best possible payout.

- Don’t be afraid to talk to more than one company, and compare settlement offers. Life/viatical settlement companies use their own calculations based on your exact policy type, the face value and cash value of your policy, and your health. Settlement offers can differ by a substantial amount.

- Be sure you understand all the ramifications of selling your whole life insurance policy. The proceeds of your settlement may be taxable, and if you have creditors, it’s possible that they could legally claim your cash payment. A cash settlement could also affect your Medicaid or public assistance status. Be an informed consumer.

One important thing to keep in mind

Like just about every other industry where money is involved, there are scammers out there looking to take advantage of the most vulnerable. That’s why your due diligence is so important. Be sure any life/viatical settlement companies you contact are reputable and licensed in your state.

If a settlement company suggests you buy and then quickly sell a life insurance policy, they may be trying to involve you in insurance fraud. Run, don’t walk away. Knowledge is your best defense against being scammed.

If you are considering the sale of your whole life insurance policy, the experts at PolicyBank® are here to help you make an informed decision.