Let’s start with a definition, because there’s some confusion as to exactly what long-term care insurance is. Long-term care insurance, also known as elder care insurance, does something that traditional health insurance does not—it covers the costs of long-term services such as assisted living facilities, nursing home care, in-home caretakers, adult day care, you get the idea. It can even cover things like home safety modifications.

With a long-term care insurance policy, you as the policy holder are reimbursed an agreed-upon amount for your daily care.

Another definition: Long-term is care of three months or more in duration.

Will you need long-term care?

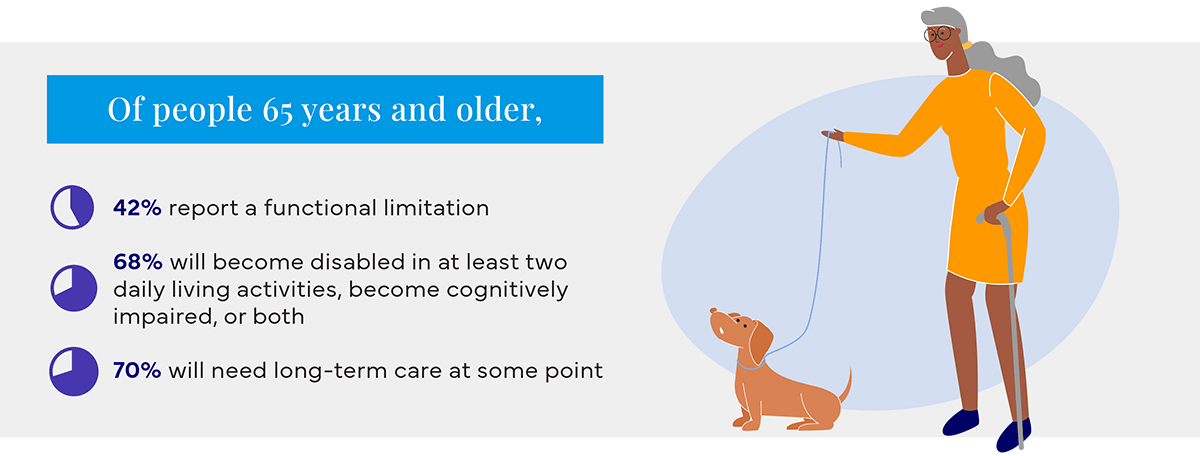

To help explore that question, here are a couple of statistics from the American Association for Long-Term Care Insurance:

- More than 42% of people aged 65 and older report a functional limitation.

- If you are aged 65 and older, there is a 68% chance that you will become disabled in at least two daily living activities, become cognitively impaired, or both.

And according to LongTermCare.gov, if you turn 65 today, you have a 70% chance of needing long-term care services at some point. For what it’s worth, women live longer on average and therefore require care for longer than men.

There is no way to know for sure if you will someday need long-term care of one kind or another, but the odds are good.

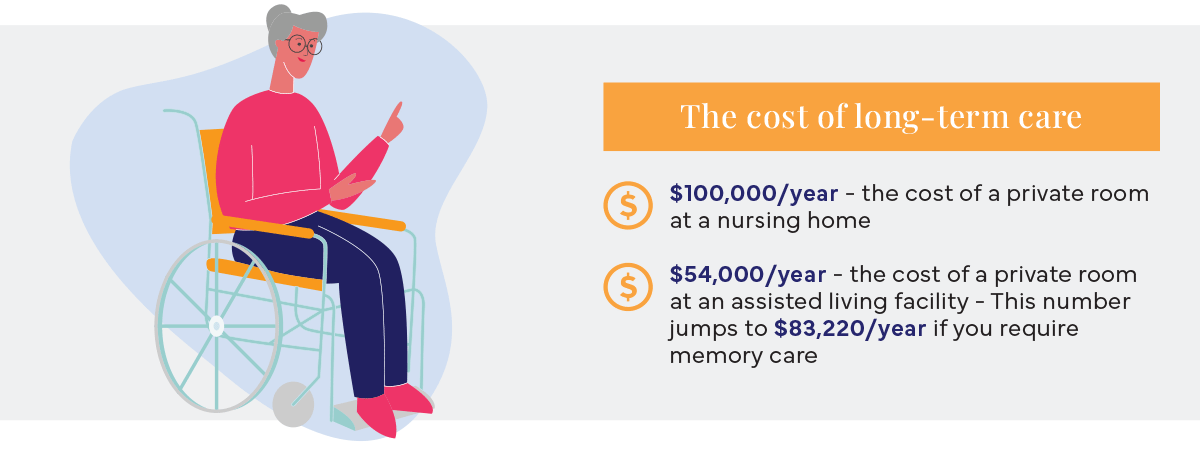

How much is long-term care?

The main reason many people consider long-term care insurance is due to the astronomical costs of long-term care. As an example:

- The average cost of a private room in a nursing home in the U.S. is a little over $9,000 per month, which is more than $100,000 per year.

- For assisted living, those numbers are $4,500 per month, $54,000 per year.

- For those requiring memory care, the cost jumps to $6,935 per month, $83,220 per year.

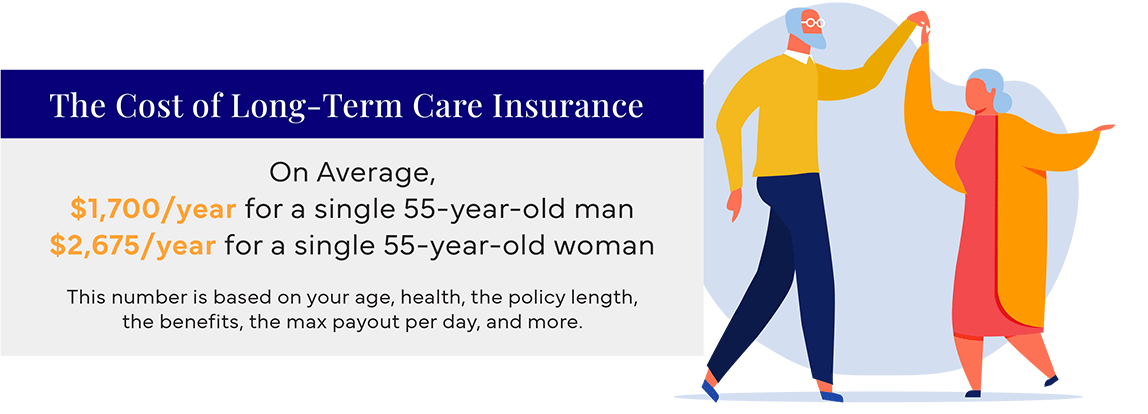

How much is long-term care insurance?

According to the American Association for Long-Term Care Insurance, the average cost of a long-term care policy for a single 55-year-old man is $1,700 per year. For a single 55-year-old woman, it’s $2,675 per year.

However, those numbers can vary significantly based on a number of factors:

- Your age when you purchase the policy.

- Your health.

- The maximum amount your policy will pay per day.

- The maximum number of years your policy will be in effect.

- The maximum amount of money the policy will pay over its life.

- The benefits included as part of your policy. As with many other types of insurance, long-term care insurance is available in a range of benefits, from bare bones base policies to “Cadillac” versions.

Another option to help pay for long-term care insurance

If you have a life insurance policy, you are legally allowed to sell it to a third party for a one-time lump sum cash payment, or settlement. There are certain criteria that must be met, but should you qualify, the funds you receive from the settlement are yours to use however you choose, and that includes paying for long-term care insurance.

So is long-term care insurance worth it?

That depends.

- Do you qualify for a long-term care insurance policy? Insurance companies that offer policies will look at the above factors, and not every person will qualify.

- Can you afford to make the monthly premium payments?

- Do you have enough personal savings to afford several years of long-term care on your own, without the benefit of an insurance policy?

Finally, although Medicare does not cover long-term care, Medicaid does cover some long-term care services. Only those truly without money qualify, and you must spend all your available assets before Medicaid begins to help.

If you are considering long-term care insurance options, the experts at PolicyBank® are here to help you make an informed decision.