There are a variety of reasons why you may choose to cancel your life insurance policy. You may no longer be able to afford the premium payments, or maybe you’ve managed to pay off your debt. Perhaps you no longer have dependents.

In any event, canceling, or surrendering, your life insurance policy is relatively straightforward. The steps involved do, however, vary depending on whether you have term life insurance or whole life insurance.

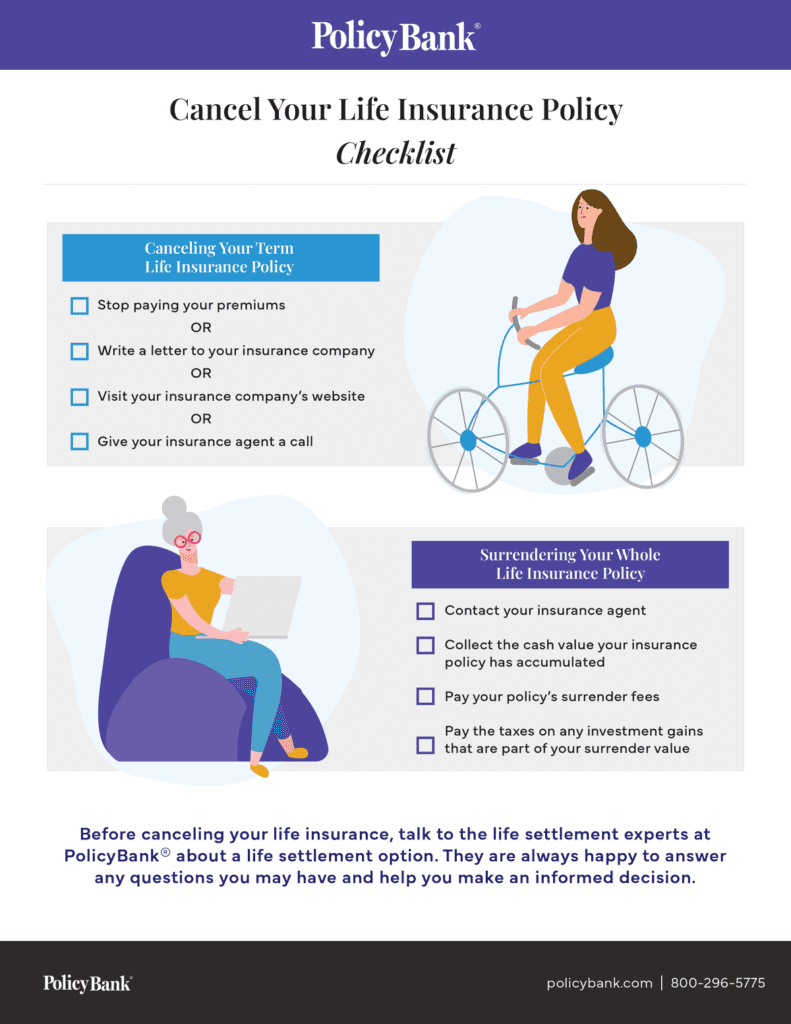

How to cancel term life insurance

Term life insurance—a policy that provides coverage for a specified amount of time, usually between 10 and 30 years, and pays a death benefit if you die during that time period—is extremely easy to cancel. You can:

- Simply stop paying your premiums. Once your grace period has expired, so will your insurance policy.

or - Write a letter to your insurance company, letting them know that you are canceling your policy.

or - Visit your insurance company’s website. Many insurance companies have a simple web form for terminating your policy.

or - Give your insurance agent a call. You may be able to cancel your policy right over the phone, or at least get the process started.

How to cancel whole life insurance

Whole life insurance is a policy into which you make premium payments throughout your lifetime, and a death benefit is paid to your beneficiary or beneficiaries. Whole life insurance policies also include a cash savings component, which accrue interest and may be borrowed from.

There are more steps involved in canceling your whole life insurance policy, which is called surrendering.

- Contact your insurance agent to begin the process of surrendering your policy.

- Collect whatever cash value your policy has accumulated. Depending on how long your policy has been in effect, that amount may be minimal.

- Pay the surrender fees as stated in your policy. Again depending on how long your policy has been in effect, those fees may be substantial.

- You may also owe taxes on any investment gains that are part of your surrender value.

A Better Option

You can legally sell both term life and whole life insurance policies to a third party for a one-time cash payment, called a settlement. With a settlement, you’ll receive a much larger payout than if you surrender your policy—at least four times more on average.

For example, with a settlement, you can receive between 10% and 35% of the death benefit, with an average of 20%—that’s $20,000 on a $100,000 life insurance policy.

There are a number of factors considered by life settlement companies when determining if your life insurance policy qualifies to be purchased, such as your age, health, the type of life insurance policy you have, and the size of the policy. A licensed, reputable life settlement company can explain the entire process and help you decide if a settlement is the right choice for you.

Are you considering canceling your life insurance? Before you do, talk to the life settlement experts at PolicyBank®. They are always happy to answer any questions you may have and help you make an informed decision.