This may seem counter-intuitive, but a well-thought-out and comprehensive end-of-life plan isn’t so much for you as it is for your loved ones. No matter how many times you share with them your end of life wishes, as the time grows near, emotions come into play. A good end of life plan, in writing, takes emotion out of the equation and gives your loved ones the comfort of knowing they are following your wishes exactly.

It helps to be open and transparent with your loved ones throughout the entire planning process so there are no surprises. Include them in conversations and let them ask any questions they may have. Truly understanding your end of life decisions will allow your loved ones to carry them out with confidence.

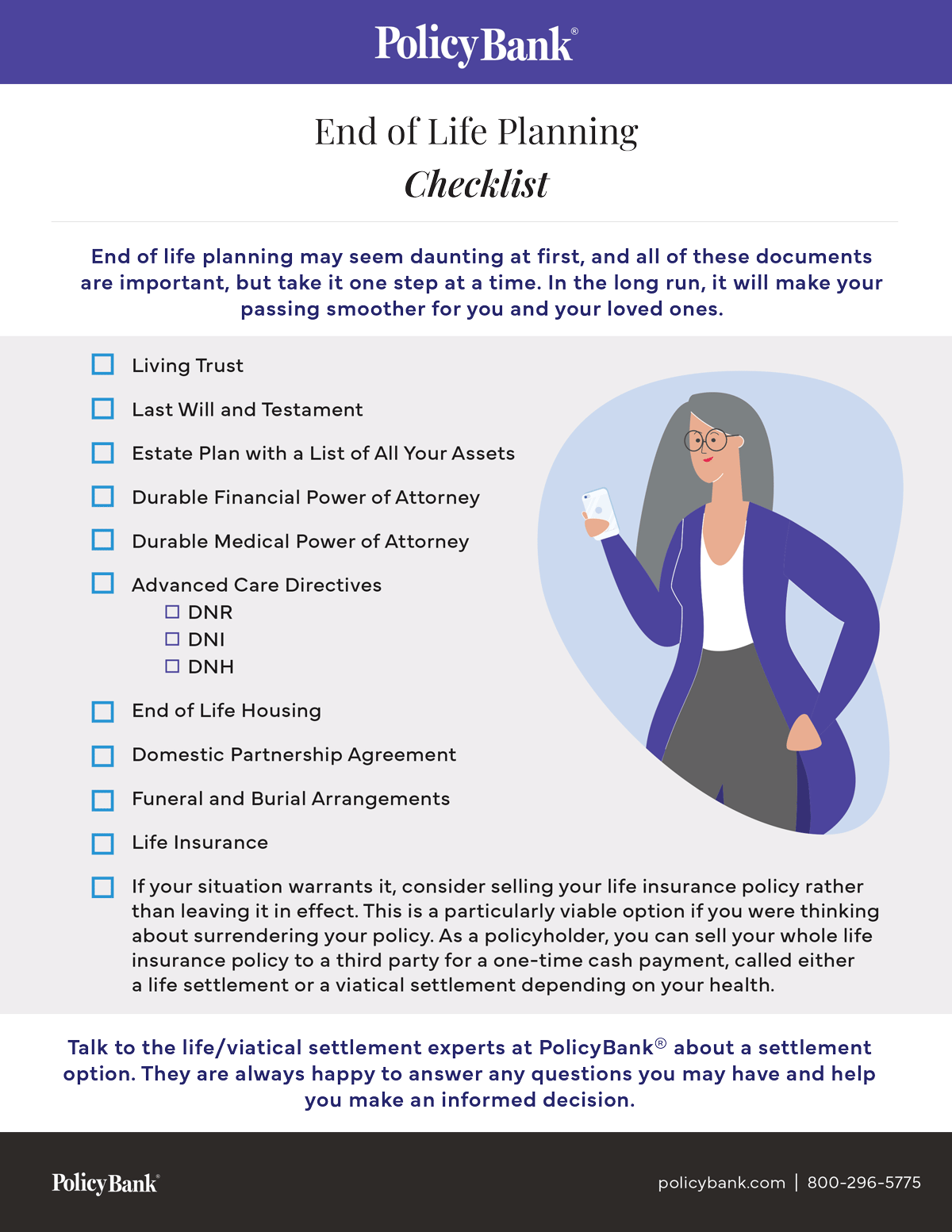

End of life planning may seem daunting at first, and all of these documents are important, but take it one step at a time. In the long run, it will make your passing smoother for you and your loved ones.

- Living Trust—Lets you manage your estate and property while alive, then distributes those assets to your heirs after your death. This allows everything within the living trust to pass to your heirs without going through probate.

- Last Will and Testament—A legal document that expresses your wishes as to who you want to receive your outstanding assets upon your death. This names the executor of your estate, who your beneficiaries are, and who will act as legal guardian if you have minor children.

- Estate Plan with a List of All Your Assets—Everything from your valuables, such as jewelry and art, to real estate, savings, investments, etc. Include account numbers.

- Durable Financial Power of Attorney—Authorizes the person of your choice to make legally binding financial decisions for you if you’re no longer able to do so on your own.

- Durable Medical Power of Attorney—Authorizes the person of your choice to make legally binding medical decisions for you if you’re no longer able to do so on your own, up to and including the decision to remove you from life support.

- Advanced Care Directives—DNR: Do Not Resuscitate. DNI: Do Not Intubate. DNH: Do No Hospitalize; this is important if you are at home under hospice care.

- End of Life Housing—Should you no longer be able to fully care for yourself, do you want to stay at home with a caregiver? Independent living? Assisted living? Long-term care (nursing home)? These decisions may partly depend on your financial situation.

- Domestic Partnership Agreement—If you are not married but have a long-term domestic partnership, this is where you specify whatever legal agreements you’ve reached with your partner.

- Funeral and Burial Arrangements—Do you want a full funeral mass, a viewing at the funeral home, or nothing at all? Do you want to be buried, and if so, where? Do you want to be cremated, or something else? Let your loved ones know so it’s one less thing for them to think about. If possible, arrange and pay for what you want beforehand.

- Life Insurance—If you have a life insurance policy, is it in good standing with premiums paid up?

Another possibility to consider

If your situation warrants it, consider selling your life insurance policy rather than leaving it in effect. This is a particularly viable option if you were thinking about surrendering your policy. As a policyholder, you can sell your whole life insurance policy to a third party for a one-time cash payment, called either a life settlement or a viatical settlement depending on your health.

If you meet the minimum qualifications, you’ll receive a much larger payout than if you surrender your policy—at least four times more on average.

A Life Settlement Company

A licensed, reputable life settlement company can walk you through the entire process and help you decide if a life/viatical settlement is the right choice for you.

If you are interested in learning more about selling your life insurance policy rather than surrendering it, contact the experts at PolicyBank® for more information so they can help you make an informed decision.